OVERCLOCK — Open Source AI Infrastructure Simulator

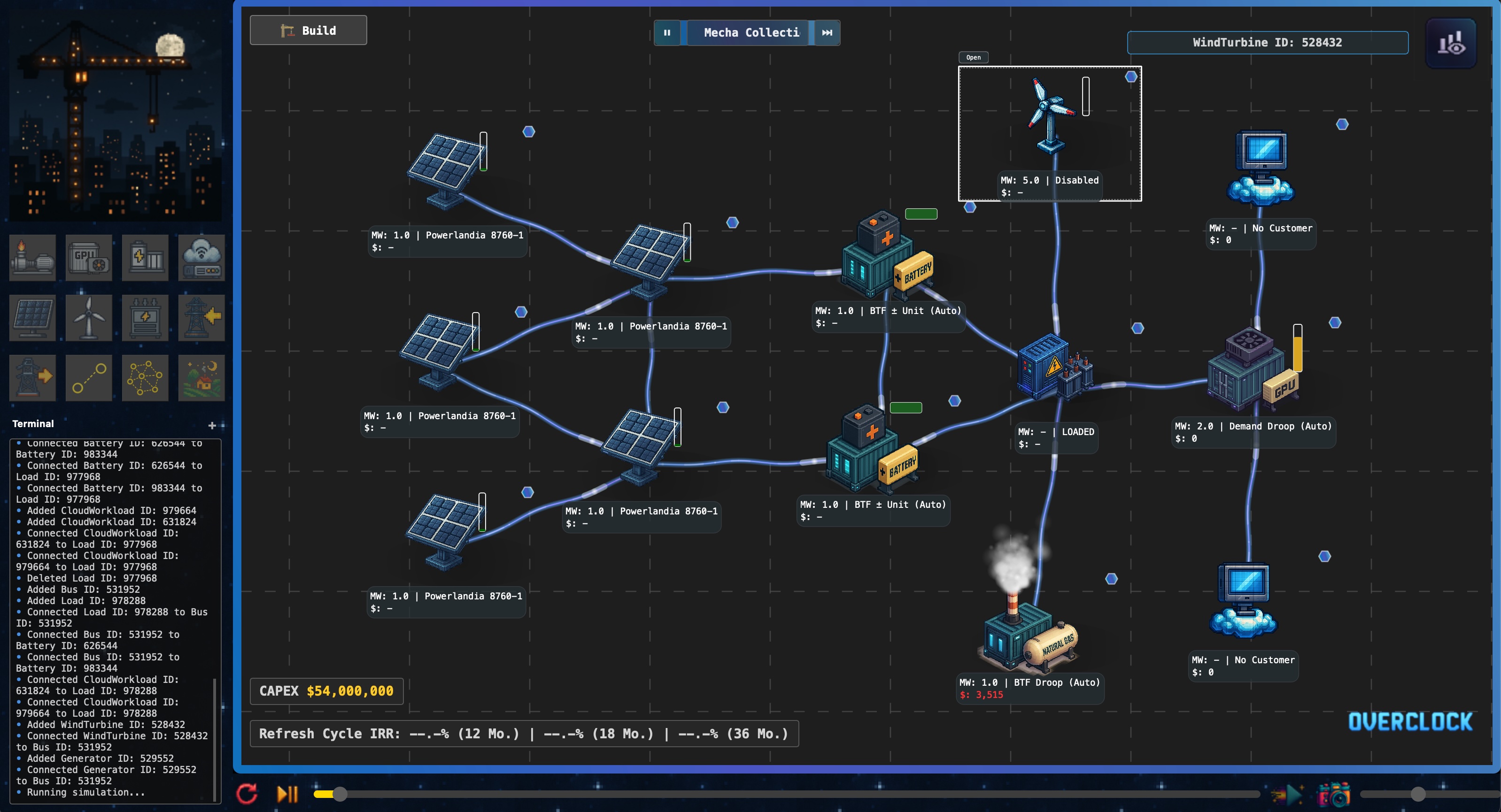

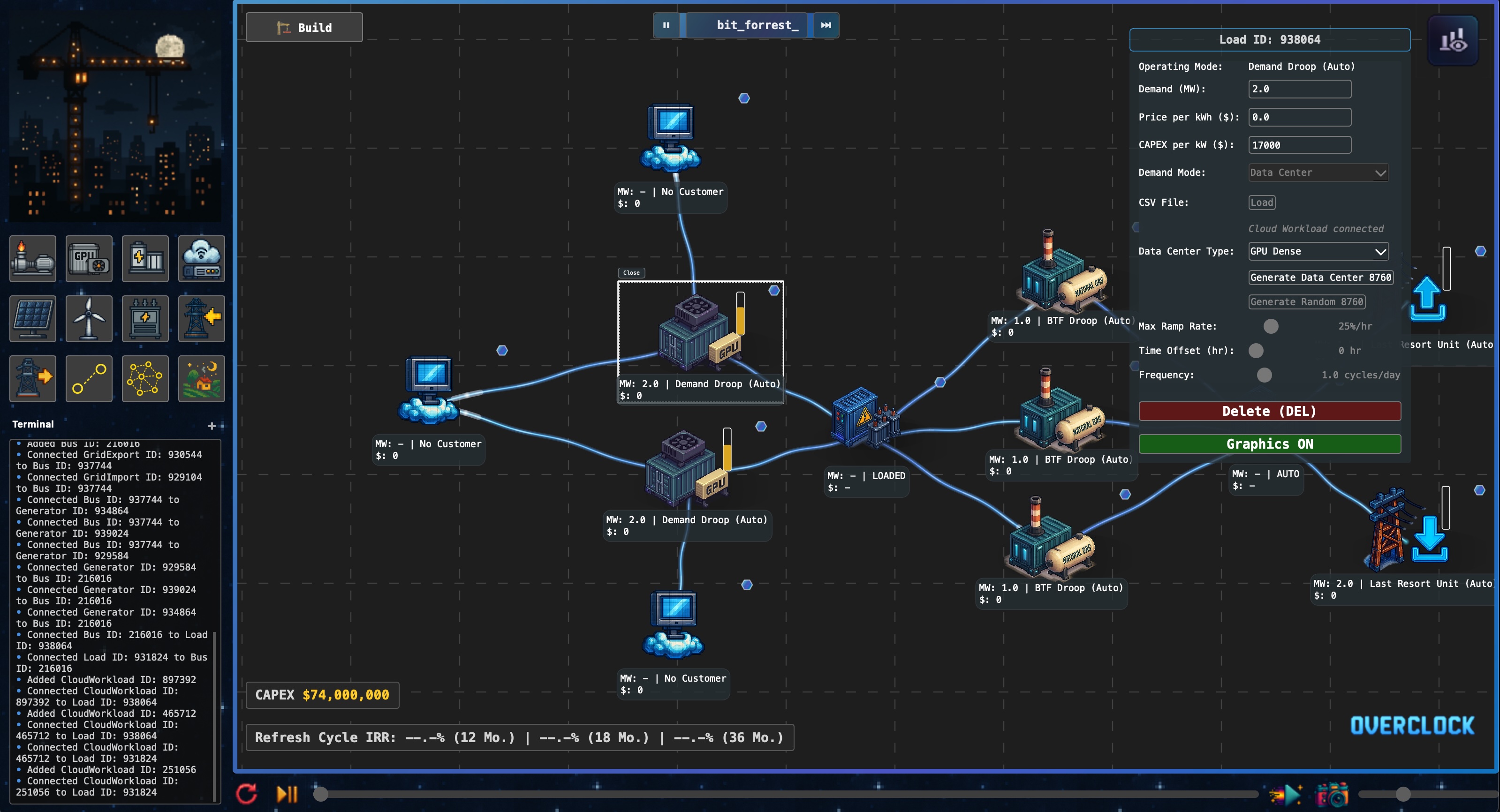

OVERCLOCK is an open source physics‑first simulator for watt‑bit infrastructure. Build, run, and analyze GPU data center power systems and AI workloads across a full 8760‑hour year. Compose networks from generators, batteries, grid import/export, buses, loads, renewables, and cloud workloads.

High-end features

- 100+ original pixel‑art graphics and UI assets for cool and memorable designs

- 25+ minutes of human‑made music with low‑latency playback and track controls

- Rich component library: generation, storage, grid I/E, buses, loads, renewables, cloud workloads

- Deep configuration across ops and commercial topics

- 8760s from deterministic dispatch, constraint‑aware scheduling, deep operations modeling

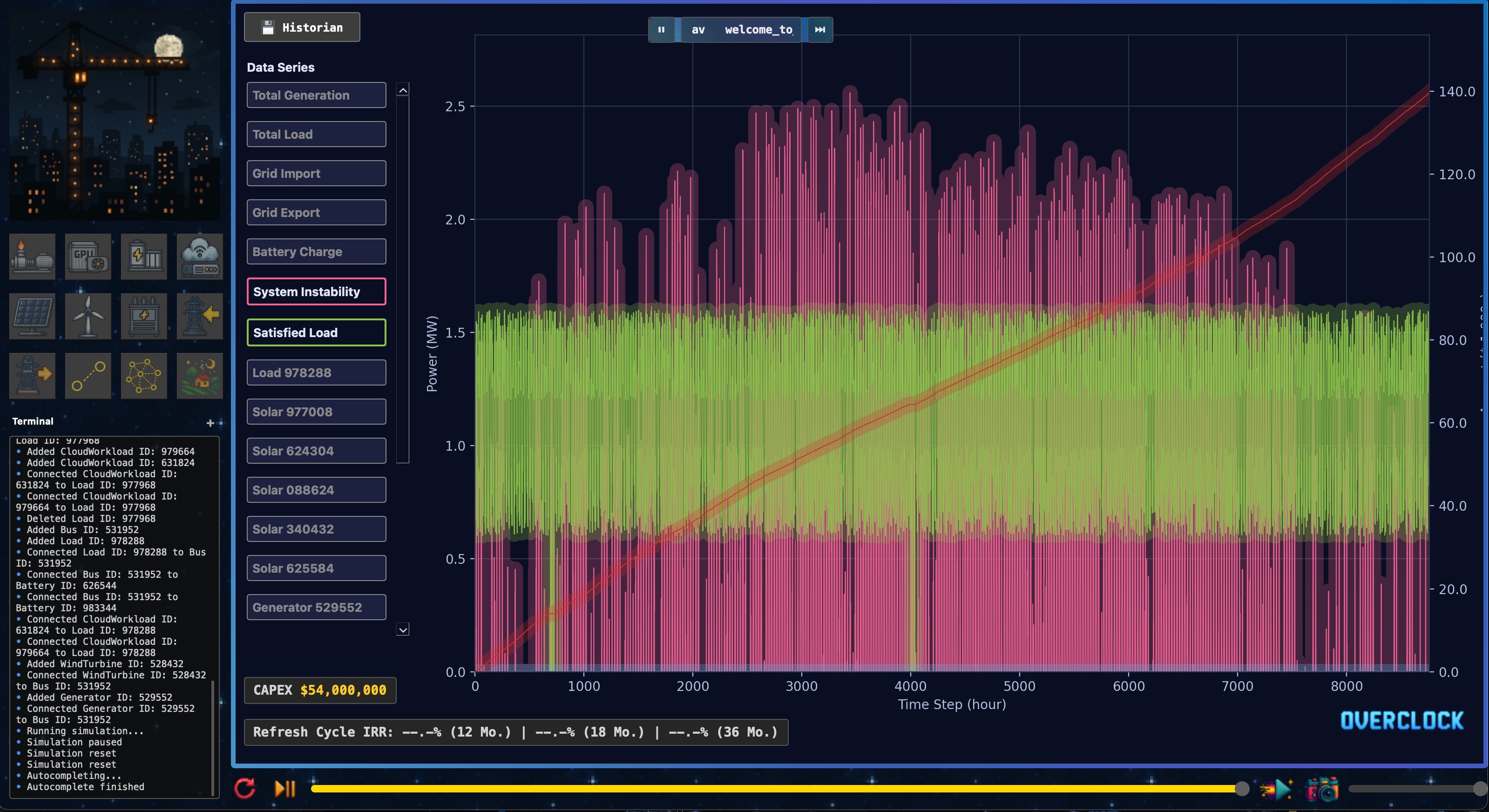

- Scenario save/load, CSV import helpers, Historian with full‑year results and live analytics

- Opinionated defaults that “just work,” with expert‑level depth there when you need it

- Shareable, branded screenshots and safe collaboration features for parallel workflows

What it’s for

- Prototyping power‑plus‑compute topologies before construction; validating duty cycles

- Pressure‑testing curtailment and availability assumptions across 8760‑hour runs

- Generating utilization and performance profiles to feed Flight Deck economics

- Answering RFPs faster with evidence‑backed visuals

- De‑risking interconnects and right‑sizing storage/firming before committing capex

- Validating BYOP strategies and framing GPU‑indexed PPAs with conviction

What it simulates

- Generators, batteries, solar/wind, grid import/export, buses, loads, and cloud workloads

- Time‑varying generation, storage behavior, imports/exports, and workload demand profiles

- External signals and price curves mapped to plant physics and cluster demand

- Focused properties with smart modes: defaults run cleanly; experts can go deep

What you see while building

- AutocompleteCAPEX and IRR overlays with 12/18/36‑month refresh windows

- Real‑time charts in the Analytics panel; Historian with full‑year results

- Flow, bottleneck, and ramp‑up visibility to explain costs and returns

Why OVERCLOCK

- Physics‑first operations for rapid iteration and clear assumption separation

- Clean visuals and fast UX help move from idea to insight in minutes

- Pairs naturally with Flight Deck to turn operations into cash flows and coverage

- Replaces brittle spreadsheets and scattered notebooks with a single auditable model

What’s included

- Node‑based modeling canvas with Autoconnect and manual wiring

- 8760‑hour simulation, real‑time analytics, and the Historian

- Scenario save/load, CSV import pipeline

- Bundled Powerlandia datasets for immediate experimentation -- no need to go hunting for data

Requirements

- Windows 10/11 or macOS 13+ (Apple Silicon and Intel)

- Unsigned beta builds may trigger OS warnings; approve on first run when prompted

“In AI infra, the physics decide the finances. OVERCLOCK shows you how your power choices become compute, then performance, then returns.”

FAQs

What exactly is OVERCLOCK?

It is a node-based simulator for AI infrastructure that models generation, storage, grid import and export, electrical distribution, and workload demand over a full year with live analytics, Historian results, and optional IRR and CAPEX overlays.

Who is it for?

Developers and operators of AI data centers, energy and grid teams, systems engineers, and investors who need an operationally grounded view before underwriting economics in Flight Deck.

Which components can I model?

Generators, batteries, solar and wind, grid import and export, buses and loads, and cloud workloads are available, with properties panels that expose key modes and parameters per component.

How does the simulation work?

You can run in real time and scrub the timeline, or use Autocomplete to simulate the entire 8760-hour year and jump to the Historian for full results.

Can I bring my own data?

Yes. Use the CSV profile workflow to import custom 8760-hour profiles; a helper dialog explains the expected format before loading.

How realistic are the outputs?

OVERCLOCK targets moderate fidelity for rapid iteration using curated datasets and opinionated defaults, with enough control in properties to reflect site-specific behavior; it does not perform market clearing or power-flow studies.

Does it forecast nodal prices or optimize dispatch?

No. Bring your own prices and policies if you need them; OVERCLOCK focuses on operational physics and time-based behavior rather than market forecasting or co-optimization.

What is the Historian?

After Autocomplete, Historian presents the full-year dataset and summary metrics, making it easy to inspect duty cycles, energy flows, and the inflection points that drive returns.

How do scenarios work?

Save, load, and create new designs as JSON. You can branch designs quickly and compare changes using the live analytics and Historian views.

How do I see economics while I build?

Live CAPEX and IRR labels are anchored to the canvas, with refresh windows of 12, 18, or 36 months to reflect staged ramp behavior and early-year dynamics.

What are the key hotkeys?

G, B, L, I, E, S, and W add the main components; C starts a connection; A autoconnects; Space runs or pauses; R resets; Enter autocompletes; backslash toggles Build and Historian; P toggles Analytics.

What does the Terminal do?

A built-in Terminal panel shows status, errors, and UX hints with colored markers so you can fix issues without intrusive popups.

Are there built-in datasets?

Yes. Powerlandia profiles for load and pool prices, along with solar and wind generation series, are bundled for immediate, moderate-fidelity experimentation.

What are the system requirements?

Windows 10 or 11 and macOS 13 or newer are supported; both Apple Silicon and Intel work. Beta builds are unsigned and may trigger OS warnings.

What should I do if the app is blocked on first run?

On Windows, choose More info then Run anyway. On macOS, open the app, then use Privacy & Security to Open Anyway when prompted; you may need to confirm twice and the first launch can take up to 30–45 seconds.

What if the simulation will not start?

Ensure you have a single connected network; the Terminal will display a red-dot error and the border will flash when connectivity is invalid.

How do I manage audio and the intro?

Music and effects are integrated with low-latency playback and precaching; you can toggle background music from the overlay and advance tracks as needed. The cinematic intro can be skipped to get straight to the canvas.